SRLEV NV Announces Results of Tender Offer for its €400,000,000 Subordinated Notes Due 2041

13 juni 2018

SRLEV NV (the Company) announces today the final results of its invitation to holders of its €400,000,000 Subordinated Notes due 2041 (ISIN: XS0616936372), of which €400,000,000 in aggregate nominal amount is currently outstanding (the Notes) to tender their Notes for purchase by the Company for cash (such invitation, the Offer).

The Company intends to cancel those Notes accepted for purchase pursuant to the Offer. The Company expects that the New Financing Condition will be satisfied on the Settlement Date.

The Offer was announced on 4 June 2018 and was made subject to satisfaction or waiver of the New Financing Condition and was made on the terms and subject to the conditions contained in the tender offer memorandum dated 4 June 2018 (the Tender Offer Memorandum) prepared by the Company. Capitalised terms used in this announcement but not defined have the meanings given to them in the Tender Offer Memorandum.

Earlier today, the Company confirmed the revised Pricing Time, the revised Pricing Date and the revised Settlement Date.

The Expiration Deadline for the Offer was 5.00 p.m. (CET) on 11 June 2018.

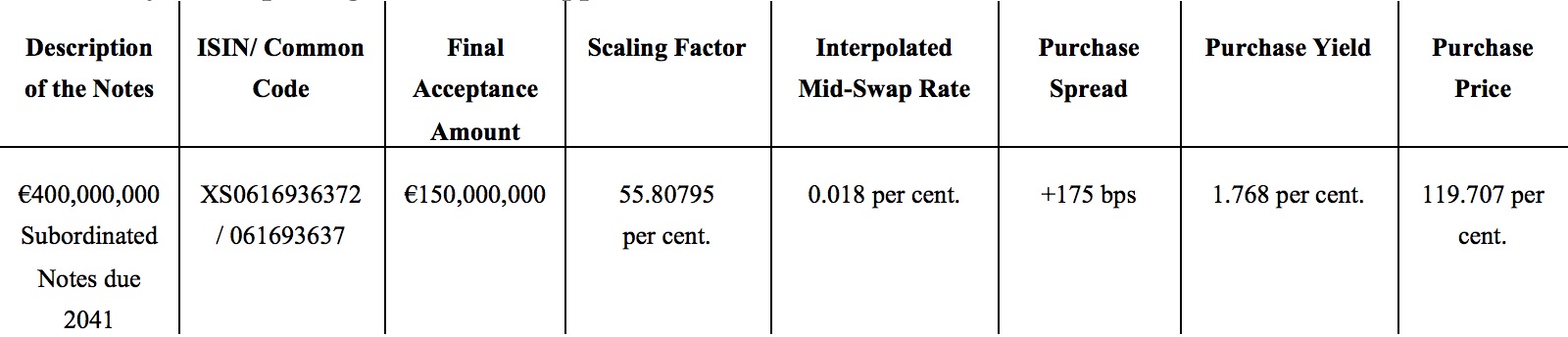

As at the Expiration Deadline, €272,550,000 in aggregate nominal amount of the Notes had been validly tendered pursuant to the Offer. The Company has decided to accept valid tenders of Notes pursuant to the Offer and to set the Final Acceptance Amount at €150,000,000 in aggregate nominal amount of Notes and a Scaling Factor of 55.80795 per cent. to be applied to Tender Instructions, subject to satisfaction or waiver of the New Financing Condition. The pricing for the Offer took place at or around 1.00 p.m. (CET) today. The Company will pay a Purchase Price of 119.707 per cent. of the nominal amount of the Notes accepted by it for purchase pursuant to the Offer and will also pay an Accrued Interest Payment in respect of such Notes.

A summary of the pricing of the Offer appears below:

The Settlement Date in respect of those Notes accepted for purchase is expected to be 20 June 2018, subject to satisfaction or waiver of the New Financing Condition. Following settlement of the Offer, €250,000,000 in aggregate nominal amount of the Notes will remain outstanding. Deutsche Bank AG, London Branch (Telephone: +44 20 7545 8011; Attention: Liability Management Group) and NatWest Markets Plc (Telephone: +44 20 7678 5282; Attention: Liability Management; Email: liabilitymanagement@natwestmarkets.com) are acting as Dealer Managers for the Offer and Lucid Issuer Services Limited (Telephone: +44 20 7704 0880; Attention: Arlind Bytyqi/Paul Kamminga; Email: vivat@lucid-is.com) is acting as Tender Agent.

This announcement is released by SRLEV NV and contains information that qualified or may have qualified as inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 (MAR), encompassing information relating to the Offer described above. For the purposes of MAR and Article 2 of Commission Implementing Regulation (EU) 2016/1055, this announcement is made by Yinhua Cao, CFO at SRLEV NV.

DISCLAIMER

This announcement must be read in conjunction with the Tender Offer Memorandum. No offer or invitation to acquire any securities is being made pursuant to this announcement. If any Noteholder is in any doubt as to the action it should take, it is recommended to seek its own financial advice, including in respect of any tax consequences, from its stockbroker, bank manager, solicitor, accountant or other independent financial or legal adviser. The distribution of this announcement and the Tender Offer Memorandum in certain jurisdictions may be restricted by law. Persons into whose possession this announcement and/or the Tender Offer Memorandum comes are required by each of the Company, the Dealer Managers and the Tender Agent to inform themselves about, and to observe, any such restrictions.

NOT FOR DISTRIBUTION IN OR INTO OR TO ANY PERSON LOCATED OR RESIDENT IN THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED STATES OR THE DISTRICT OF COLUMBIA (INCLUDING PUERTO RICO, THE US VIRGIN ISLANDS, GUAM, AMERICAN SAMOA, WAKE ISLAND AND THE NORTHERN MARIANA ISLANDS) OR IN OR INTO OR TO ANY PERSON LOCATED OR RESIDENT IN ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.